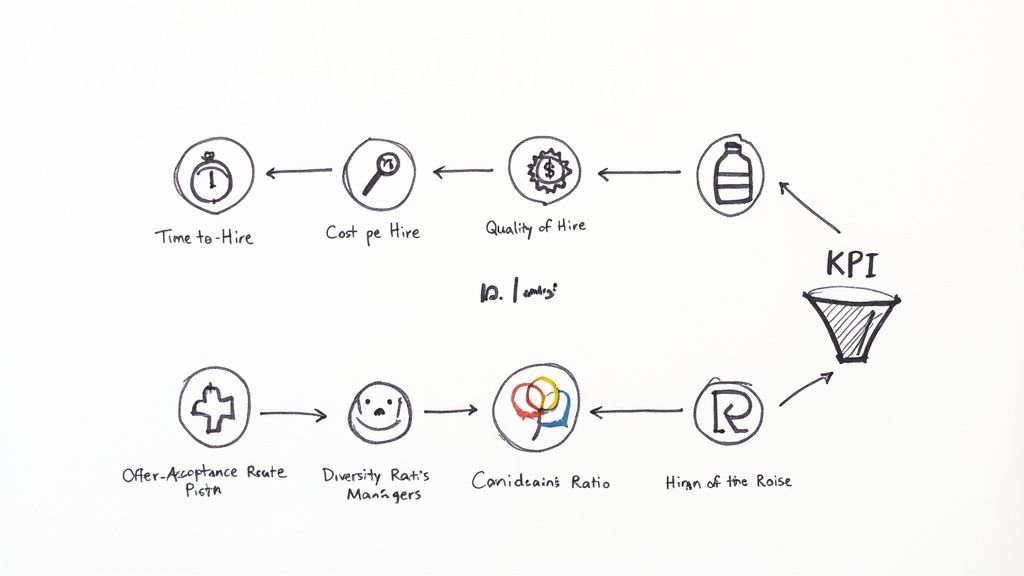

In the competitive world of hiring, gut feelings and intuition are no longer enough to build a winning team. Modern recruitment demands a data-driven approach, and that's where Key Performance Indicators (KPIs) become indispensable. Going beyond simply filling seats, a well-defined set of recruitment KPIs transforms your hiring process from a cost center into a strategic, value-driving function. These metrics provide objective insights into your team's efficiency, effectiveness, and overall impact on business goals.

By tracking the right data, you can pinpoint bottlenecks, optimize spending, and consistently improve the quality of candidates you bring on board. The strategic importance of these metrics extends to the broader field of talent acquisition, where data informs every stage from sourcing to onboarding. This guide moves past the theoretical to give you a practical, actionable list of the most critical recruitment KPIs. For each one, we will break down what it is, how to calculate it, what good looks like, and how you can use it to make smarter, faster, and more impactful hiring decisions. We’ll cover everything from foundational metrics like Time to Fill and Cost per Hire to more nuanced indicators like Quality of Hire and Candidate Net Promoter Score.

1. Time to Fill

Time to Fill is a foundational recruitment KPI that measures the total number of calendar days from the moment a job requisition is approved and opened to the day a candidate accepts a formal offer. This metric provides a high-level view of your entire recruitment cycle's efficiency, encompassing sourcing, screening, interviewing, and offer stages. A shorter Time to Fill often correlates with a better candidate experience and lower recruitment costs.

Why It's an Essential Recruitment KPI

This metric directly impacts business operations. A lengthy Time to Fill means a critical role remains vacant, leading to lost productivity, strained team morale, and potential revenue loss. Monitoring it helps identify bottlenecks in your hiring funnel, whether it's a slow resume screening process or delays in scheduling final-round interviews. For HR managers, it's a crucial indicator of the team's overall performance and capacity.

Key Insight: Don't confuse Time to Fill with Time to Hire. Time to Hire measures the time from when a candidate enters your pipeline (e.g., applies) to when they accept an offer, reflecting candidate velocity. Time to Fill reflects the entire process efficiency from the business's perspective.

How to Calculate and Optimize

Calculating Time to Fill is straightforward:

Formula: (Date of Offer Acceptance) - (Date of Job Requisition Approval) = Time to Fill in Days

To improve your Time to Fill, focus on targeted optimizations:

- Refine Job Descriptions: Vague job descriptions attract unqualified applicants, wasting screening time. Ensure they are clear, concise, and accurately reflect the role's requirements.

- Build Talent Pools: Proactively source and engage with potential candidates for future openings. This drastically reduces sourcing time when a new requisition opens.

- Streamline Interview Stages: Standardize your interview process and use tools for automated scheduling to eliminate back-and-forth communication delays.

- Set SLAs: Establish Service Level Agreements with hiring managers for feedback turnaround to keep the process moving.

2. Time to Hire

Time to Hire is a candidate-centric recruitment KPI that measures the average number of days from a candidate's first point of contact with your company (e.g., submitting an application) to the moment they accept a formal job offer. This metric specifically evaluates the speed and efficiency of your hiring process from the applicant's perspective, directly influencing their experience. A faster Time to Hire improves your employer brand and reduces the risk of losing top talent to competitors.

Why It's an Essential Recruitment KPI

This metric is a direct reflection of your candidate experience. A long and drawn-out process creates frustration and uncertainty, causing skilled candidates to drop out of your pipeline. Tracking Time to Hire helps you pinpoint inefficiencies within your active recruitment stages, such as delays in screening, prolonged interview rounds, or slow offer approvals. For talent acquisition teams, it is a critical measure of agility and competitiveness in a tight labor market. For example, a global consulting firm found its Time to Hire for employee referrals was just 10 days, compared to 24 days for candidates from job boards, prompting a strategy shift.

Key Insight: While Time to Fill measures the entire vacancy period from a business need perspective, Time to Hire isolates the candidate journey. Analyzing both recruitment kpis gives you a complete picture: one showing internal process efficiency (Time to Fill) and the other showing candidate pipeline velocity (Time to Hire).

How to Calculate and Optimize

Calculating Time to Hire is a direct measure of candidate pipeline speed:

Formula: (Date of Offer Acceptance) - (Date of Candidate's First Contact/Application) = Time to Hire in Days

To improve your Time to Hire, focus on enhancing the candidate's journey:

- Standardize 'First Contact': Ensure your Applicant Tracking System (ATS) consistently logs the 'first contact' date, whether it's an application, a referral entry, or a sourced contact.

- Use Scheduling Software: Eliminate the back-and-forth delays of coordinating interviews by implementing automated interview-scheduling tools.

- Set Clear Timelines: Communicate the expected hiring process timeline to candidates upfront to manage expectations and maintain engagement.

- Implement Structured Interviews: Using scorecards and standardized questions ensures a fair, efficient, and faster evaluation process, as seen when a fintech startup reduced its Time to Hire from 35 to 18 days. To explore more strategies, you can learn more about how to reduce Time to Hire.

3. Cost per Hire

Cost per Hire is one of the most critical financial recruitment KPIs, measuring the total internal and external expenses invested to make a single hire. This metric provides a clear view of your recruitment budget's efficiency and helps justify spending on different sourcing channels, technologies, and team resources. Tracking it reveals the true ROI of your talent acquisition efforts and guides strategic financial planning.

Why It's an Essential Recruitment KPI

This metric directly ties recruitment activities to the company's bottom line, making it a powerful tool for conversations with leadership. A high Cost per Hire can signal inefficient spending or over-reliance on expensive channels like recruitment agencies. For example, a multinational corporation might track this KPI quarterly to align recruitment spend with hiring velocity, while an e-commerce brand could discover it can cut costs by 20% by shifting from agencies to a robust employee referral program. Understanding these costs is fundamental to building a scalable and sustainable talent acquisition function.

Key Insight: A comprehensive Cost per Hire calculation should include both direct (e.g., job board fees, agency commissions) and indirect costs (e.g., recruiter salaries, interview time of hiring managers). Excluding indirect costs gives an incomplete and misleading picture of your true investment.

How to Calculate and Optimize

Calculating Cost per Hire requires a thorough accounting of all recruitment-related expenses over a specific period.

Formula: (Total Internal Recruiting Costs + Total External Recruiting Costs) / (Total Number of Hires in a Period) = Cost per Hire

To improve your Cost per Hire, focus on strategic resource allocation:

- Establish a Consistent Formula: Work with finance and leadership to agree on exactly which costs are included. This ensures everyone trusts the data and uses it for accurate decision-making.

- Amortize Major Investments: For one-time expenses like an ATS implementation, spread the cost over its expected lifespan (e.g., 2-3 years) and allocate a portion to each hire to avoid skewing short-term data.

- Invest in High-ROI Channels: Analyze the cost and quality of hires from each source. Double down on what works best, whether it's employee referrals, direct sourcing, or targeted social media campaigns.

- Optimize Your Process: A more efficient recruitment process reduces man-hours, which is a major internal cost. Implementing a better recruitment process template can directly lower your overall spend per hire.

4. Quality of Hire

Quality of Hire is arguably the most impactful, yet most challenging, of all recruitment KPIs. It measures the value a new employee brings to the company over their first six to twelve months. This value is assessed through a combination of metrics like job performance, productivity, cultural fit, and their effect on team dynamics. Ultimately, this KPI links hiring efforts directly to long-term business outcomes, answering the critical question: "Are we hiring people who truly succeed?"

Why It's an Essential Recruitment KPI

While other metrics gauge the efficiency of the hiring process, Quality of Hire measures its effectiveness. A low cost-per-hire is meaningless if the new employee underperforms and leaves within a year, creating a cycle of rehiring. Tracking this KPI provides deep insights into the success of your sourcing channels, interview techniques, and selection criteria. For instance, you might discover that candidates sourced via employee referrals consistently achieve higher performance scores, justifying further investment in your referral program.

Key Insight: Quality of Hire is not a single number but a composite score. Its components must be defined before the role is even posted. Leading thinkers like Josh Bersin have long advocated for its use to shift recruitment from a cost center to a strategic value-driver.

How to Calculate and Optimize

Calculating Quality of Hire requires a formula that blends several data points. A common approach is to average post-hire metrics on a 100-point scale:

Formula: (New Hire Performance Score % + New Hire Productivity % + 12-Month Retention %) / 3 = Quality of Hire Score

To improve your Quality of Hire, focus on aligning recruitment with on-the-job success:

- Define Success Criteria Early: Work with hiring managers to create a "success profile" for each role, outlining specific performance expectations for the first year.

- Use a Consistent Rating System: Implement a standardized scorecard for interviews and a uniform scale for performance reviews to ensure data is comparable across departments and roles.

- Combine Short- and Long-Term Data: Use 90-day check-ins for early performance indicators and supplement them with annual performance reviews for a holistic view.

- Correlate with Pre-Hire Data: Analyze which assessment scores, interview feedback, or source channels lead to the highest-quality hires to refine your future strategy.

5. Offer Acceptance Rate

The Offer Acceptance Rate is a critical recruitment KPI that measures the percentage of formal job offers extended by your organization that are accepted by candidates. This metric is a powerful litmus test for the attractiveness of your employment proposition, the competitiveness of your compensation packages, and the overall effectiveness of your late-stage hiring process. A high acceptance rate indicates that your offers are well-aligned with candidate expectations and market realities.

Why It's an Essential Recruitment KPI

This metric provides direct feedback on your company's desirability in the talent market. A low or declining Offer Acceptance Rate is a major red flag, signaling potential issues with your compensation strategy, benefits, company culture, or even the performance of hiring managers during the final stages. Tracking this KPI helps you pinpoint why you are losing top talent at the finish line, allowing you to make data-driven adjustments instead of guessing. For recruitment teams, it's a key indicator of how well they close candidates and sell the company's value proposition.

Key Insight: A low Offer Acceptance Rate can have a cascading negative effect on other recruitment KPIs. Every rejected offer resets the clock, increasing your Time to Fill, driving up Cost per Hire, and potentially damaging your employer brand if candidates share negative experiences.

How to Calculate and Optimize

Calculating this KPI is simple and reveals immediate insights:

Formula: (Number of Accepted Offers / Total Number of Offers Extended) x 100 = Offer Acceptance Rate (%)

To improve your Offer Acceptance Rate, focus on the final stages of the candidate journey:

- Conduct Pre-Offer Alignment Calls: Before extending a formal offer, have a transparent conversation to discuss compensation expectations, benefits, and start dates. This surfaces any major misalignments early.

- Benchmark Compensation Aggressively: Regularly use up-to-date market data to ensure your salary and benefits packages are competitive for the role, industry, and location.

- Systematically Collect Feedback: When an offer is declined, use a structured exit survey or a brief call to understand the exact reason. Was it compensation, a competing offer, or culture fit? Use this data to spot trends.

- Maintain Engagement: Keep the candidate "warm" between the offer and their start date with regular, positive communication. This reinforces their decision and reduces the risk of them backing out.

6. Source of Hire

Source of Hire is a critical recruitment KPI that tracks the origins of your successful candidates, revealing which channels deliver the most actual hires. This metric goes beyond simply tracking applicant sources; it focuses on the final outcome, allowing you to determine the true return on investment (ROI) for each sourcing channel, whether it’s employee referrals, specific job boards, social media campaigns, or recruitment agencies.

Why It's an Essential Recruitment KPI

Knowing your Source of Hire is fundamental to strategic talent acquisition and budget allocation. Without this data, you risk wasting significant resources on channels that generate high applicant volume but few, if any, quality hires. Tracking this KPI enables you to double down on what works and cut spending on what doesn’t. For example, a consulting firm might discover that a niche industry forum, despite its lower applicant numbers, yields a far better interview-to-hire ratio than a generalist job board, prompting a strategic pivot in ad spend.

Key Insight: To get the most value, analyze Source of Hire alongside Source of Quality. A channel might be your top source of hires, but if those hires consistently underperform or have high turnover rates, it’s not a truly effective source.

How to Calculate and Optimize

Calculating Source of Hire requires consistent data tracking for each new employee:

Formula: (Number of Hires from a Specific Source / Total Number of Hires) * 100 = % of Hires from Source

To improve your sourcing strategy using this KPI:

- Mandate ATS Data Entry: Make the "source" field mandatory in your Applicant Tracking System for every candidate profile to ensure clean, comprehensive data.

- Run Channel Audits: Periodically audit your data to validate channel attribution. Ask candidates during interviews, "How did you hear about us?" to cross-reference and correct any inaccuracies.

- Pilot New Channels: Before committing a large budget, test emerging channels with a small, controlled pilot program. Track performance closely to decide if it’s worth scaling.

- Analyze by Role: Don't just look at overall source data. Break it down by department or role type. The best source for engineers might be different from the best source for sales representatives.

7. Candidate Net Promoter Score (cNPS)

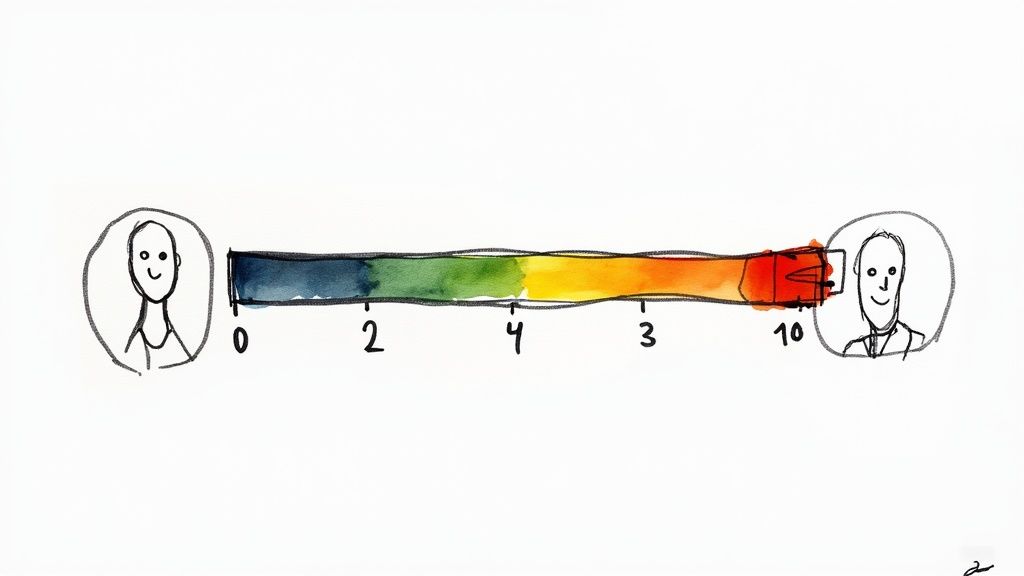

Candidate Net Promoter Score (cNPS) is a crucial experience-focused metric that gauges how likely a candidate is to recommend your company's hiring process to their network. It's typically measured by asking a single question: "On a scale of 0-10, how likely are you to recommend our hiring process to a friend or colleague?" This KPI provides a direct, quantitative measure of your candidate experience and its impact on your employer brand.

Why It's an Essential Recruitment KPI

In a hyper-connected world, a poor candidate experience can rapidly damage your company's reputation and deter top talent. The cNPS is one of the most powerful recruitment KPIs because it distills the entire, complex candidate journey into a single, actionable score. A high cNPS indicates a positive, respectful, and efficient process, turning candidates- even rejected ones- into brand ambassadors. Conversely, a low score is an immediate red flag, signaling friction points that need urgent attention, from poor communication to disorganized interviews. Manufacturer K, for example, uses quarterly cNPS pulse checks to drive specific recruiter coaching and process improvements.

Key Insight: Don't just focus on the final score. The real value of cNPS comes from segmenting the data. Analyze scores by stage (e.g., application, phone screen, final interview) and by outcome (hired vs. rejected) to pinpoint exactly where your process is succeeding or failing.

How to Calculate and Optimize

Calculating your cNPS involves categorizing responses and applying a simple formula:

Formula: (% of Promoters [scores 9-10]) - (% of Detractors [scores 0-6]) = cNPS Score

To improve your cNPS, focus on enhancing the candidate's journey:

- Survey Promptly: Send cNPS surveys within 24 hours of a key interaction (like a final interview or a rejection email) to ensure feedback is fresh and accurate.

- Ask "Why?": Always pair the numerical question with an open-ended follow-up, such as "What was the main reason for your score?" This qualitative data is gold for identifying specific improvement areas.

- Improve Communication: Proactively communicate timelines, provide constructive feedback when possible, and ensure every applicant receives a final disposition. For more strategies, learn how to improve candidate experience on asyncinterview.io.

- Share Results Transparently: Make cNPS a core metric for the recruiting team. Share the scores and feedback regularly to foster accountability and motivate continuous improvement.

8. New Hire Retention Rate

New Hire Retention Rate measures the percentage of newly hired employees who remain with the company after a specific period, typically 90, 180, or 365 days. This metric extends beyond the hiring event itself, serving as a powerful indicator of hiring quality, onboarding effectiveness, and the alignment between the new employee and the company culture. A high retention rate suggests that recruiters are finding candidates who are not only skilled but also a strong long-term fit.

Why It's an Essential Recruitment KPI

This KPI directly links recruitment efforts to long-term business stability and value. High early-stage turnover is incredibly costly, encompassing wasted recruitment expenses, training investments, and lost productivity. Tracking this rate helps diagnose issues that traditional recruitment KPIs might miss, such as a disconnect between the role as advertised and the actual job, or a flawed onboarding process that fails to integrate new hires. For talent acquisition leaders, it validates the quality of their team's placements and demonstrates a tangible return on investment.

Key Insight: A low New Hire Retention Rate is often a shared problem between recruitment and management. It could signal that recruiters are setting unrealistic expectations, or that managers are failing to support and engage new team members effectively during their critical first few months.

How to Calculate and Optimize

Calculating this KPI requires tracking employee start and end dates.

Formula: (Number of New Hires Who Remained Employed for the Full Period) / (Total Number of New Hires in That Cohort) * 100 = New Hire Retention Rate %

To boost your retention rate, focus on the post-hire experience:

- Structure Onboarding: Create a detailed 90-day onboarding plan with clear milestones, training modules, and regular check-ins. A peer-mentorship program, for instance, can improve 90-day retention significantly.

- Engage Hiring Managers: Equip managers with tools and training to conduct effective early-stage feedback sessions and set clear performance expectations from day one.

- Analyze Early Exits: When an employee leaves within the first year, conduct a thorough exit interview to identify systemic issues in the hiring or onboarding process.

- Align Incentives: Consider tying a small portion of recruiter or hiring manager incentives to 90- or 180-day retention outcomes to ensure a focus on quality over speed. For a deeper dive, exploring strategies for employee retention for remote teams can provide valuable insights for modern work environments.

Recruitment KPIs Comparison Table

| Metric | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Time to Fill | Moderate – tracks full cycle | Medium – requires ATS & process tracking | Improved hiring efficiency, bottleneck ID | Workforce planning, benchmarking across roles/locations | End-to-end process visibility, benchmarking |

| Time to Hire | Moderate – focus on candidate pipeline | Medium – needs precise candidate tracking | Better candidate experience, reduced drop-off | Optimizing candidate engagement, brand perception | Highlights candidate risks, improves engagement |

| Cost per Hire | High – requires detailed cost tracking | High – involves financial and recruiting data | Budget optimization, ROI insights | Budget justification, sourcing strategy | Reveals cost inefficiencies, supports strategic spend |

| Quality of Hire | High – integrates performance data | High – needs cross-functional data integration | Improved long-term hire impact | Linking recruiting to business outcomes, refining profiles | Direct tie to performance, encourages long-term focus |

| Offer Acceptance Rate | Low – simple calculation | Low – offer and acceptance data | Employer brand competitiveness, process issues | Evaluating offer competitiveness, candidate satisfaction | Quick, actionable metric on employer attractiveness |

| Source of Hire | Moderate – channel tracking | Medium – ATS tagging and audits | Optimized sourcing investments | Channel performance, diversity goals | Identifies high-yield channels, supports diversity |

| Candidate Net Promoter Score (cNPS) | Moderate – survey deployment | Medium – survey tools and response tracking | Enhanced candidate experience feedback | Candidate experience measurement, employer branding | Clear, actionable candidate feedback metric |

| New Hire Retention Rate | Moderate – tracking post-hire data | Medium – HRIS integration | Insights on onboarding effectiveness | Onboarding evaluation, cultural fit assessment | Links hiring quality to workforce stability |

From Data to Decisions: Building a Future-Proof Hiring Engine

Navigating the complexities of modern talent acquisition can feel like steering a ship through a storm without a compass. The comprehensive list of recruitment KPIs detailed in this guide, from Time to Fill to New Hire Retention Rate, serves as that essential navigational tool. These aren't just abstract metrics; they are the vital signs of your hiring health, providing a clear, data-driven narrative of what’s working, what isn't, and where your greatest opportunities for improvement lie.

Moving beyond simply tracking these numbers is where the real transformation begins. The goal is to evolve from reactive data collection to proactive, strategic decision-making. By weaving these KPIs into the fabric of your recruitment process, you shift from guesswork to a predictable, optimized, and powerful hiring engine.

Turning Insights into Actionable Strategy

The true value of mastering your recruitment KPIs is the ability to connect the dots. A low Offer Acceptance Rate isn't just a number; it might signal an issue with compensation benchmarks (informed by Cost per Hire analysis) or a poor candidate experience (revealed by your Candidate Net Promoter Score). A high New Hire Retention Rate is a direct reflection of a successful Quality of Hire metric. Each KPI is a piece of a larger puzzle, and understanding their interplay is crucial for building a holistic and resilient talent strategy.

Your immediate next steps should be focused on implementation and integration:

- Establish Your Baseline: You cannot improve what you do not measure. Start by calculating your current performance for at least three to four core KPIs, such as Time to Hire, Cost per Hire, and Quality of Hire. This baseline is your starting point.

- Set Realistic, Incremental Goals: Don't aim to overhaul everything overnight. Set achievable quarterly goals. For example, aim to reduce your Time to Fill by 10% or improve your Offer Acceptance Rate by 5% in the next quarter.

- Integrate Technology Strategically: Manual tracking is prone to errors and inefficiencies. Leverage your Applicant Tracking System (ATS) to its fullest potential. To further automate and streamline your HR and recruitment processes, considering the use of tools like HR chatbots can significantly reduce administrative burdens on your team, allowing them to focus on high-impact, strategic tasks.

Ultimately, a data-informed recruitment function is a powerful competitive advantage. It allows you to attract top-tier talent more efficiently, reduce hiring costs, improve new hire performance, and build a workforce that is truly aligned with your organization's long-term vision. The journey from data to decisions is ongoing, but with the right recruitment KPIs as your guide, you are well-equipped to build a future-proof hiring engine that drives sustainable business growth.

Ready to dramatically improve your Time to Hire and Quality of Hire? Async Interview helps you screen more candidates in less time with one-way video interviews, empowering you to identify top talent faster. See how our asynchronous platform can transform your recruitment process by visiting Async Interview today.