A candidate experience survey isn't just another HR checkbox. It’s your secret weapon for figuring out why top talent keeps ghosting you. Think of it as a brutally honest exit interview you give to applicants to find out what really went down—from your confusing job ads to that one interviewer who clearly didn't read their resume.

The goal? Stop guessing and start fixing what’s broken in your hiring process.

Your Hiring Process Is a Leaky Bucket

Let's be honest. You probably think your hiring process is pretty solid. But chances are, your pipeline has more holes than a block of Swiss cheese. Top candidates are vanishing, taking counteroffers, or—even worse—telling their entire network how disorganized the whole ordeal was.

You're losing great people and bleeding money without even knowing why.

This isn't just about hurt feelings; it’s about cold, hard cash. A sharp candidate experience survey is your diagnostic tool. It finds and plugs the leaks in your talent pipeline before your best prospects slip through for good.

Stop Guessing and Start Measuring

Most founders I talk to operate on gut feelings. They assume candidates drop off because of salary or a competing offer. Hope you enjoy spending your afternoons guessing your way to a better process—because that’s now your full-time job, with zero ROI.

The truth is often hiding in plain sight, buried in the small frustrations of your process.

This is where the numbers get loud. Research shows that 66% of job applicants accepted offers primarily because the recruitment process simply felt good. On the flip side, 36% declined offers after a negative interview experience alone. This isn't a rounding error; it’s a massive signal that the how of hiring matters just as much as the what. You can explore the full findings on these recruiting statistics to see just how critical this is.

You're not just filling a role; you're selling an experience from the very first click. Every confusing application form, every delayed email, and every unprepared interviewer chips away at a candidate’s excitement.

A well-crafted survey moves you from guessing to knowing. It stops you from mortgaging the ping-pong table for a bigger salary budget when the real problem is that your interview scheduling is a chaotic mess. It's time to turn painful candidate drop-offs into your biggest competitive advantage by finally listening to what they’re trying to tell you.

How to Design a Survey People Actually Finish

If your survey reads like a legal document or a psych exam, forget about getting responses. It's a classic mistake. Most candidate experience survey templates are built by folks who’ve never been on the receiving end of a truly awful hiring process. They're sterile, robotic, and ask questions that give you zero actionable insight.

We're tossing those out.

The goal isn't just to send a survey; it's to get the unfiltered truth from people who have no real obligation to give it to you. That means you've got to respect their time and ask sharp, targeted questions that get right to the point.

The Anatomy of a Killer Survey

First things first: keep it short. Seriously. No one has 20 minutes to fill out a dissertation on your interview process. Your sweet spot is something they can complete in under three minutes. Anything longer, and you're practically begging for drop-offs.

Next, your opening can't sound like it was written by a corporate lawyer. Ditch the jargon and just be human. A simple, "Hey [Name], we're always trying to make our hiring process better and would love your honest take. It'll take 2 minutes," works wonders.

A great survey feels less like an interrogation and more like a quick, confidential chat. It shows you genuinely care about their perspective, not just about checking a box for your quarterly KPI report.

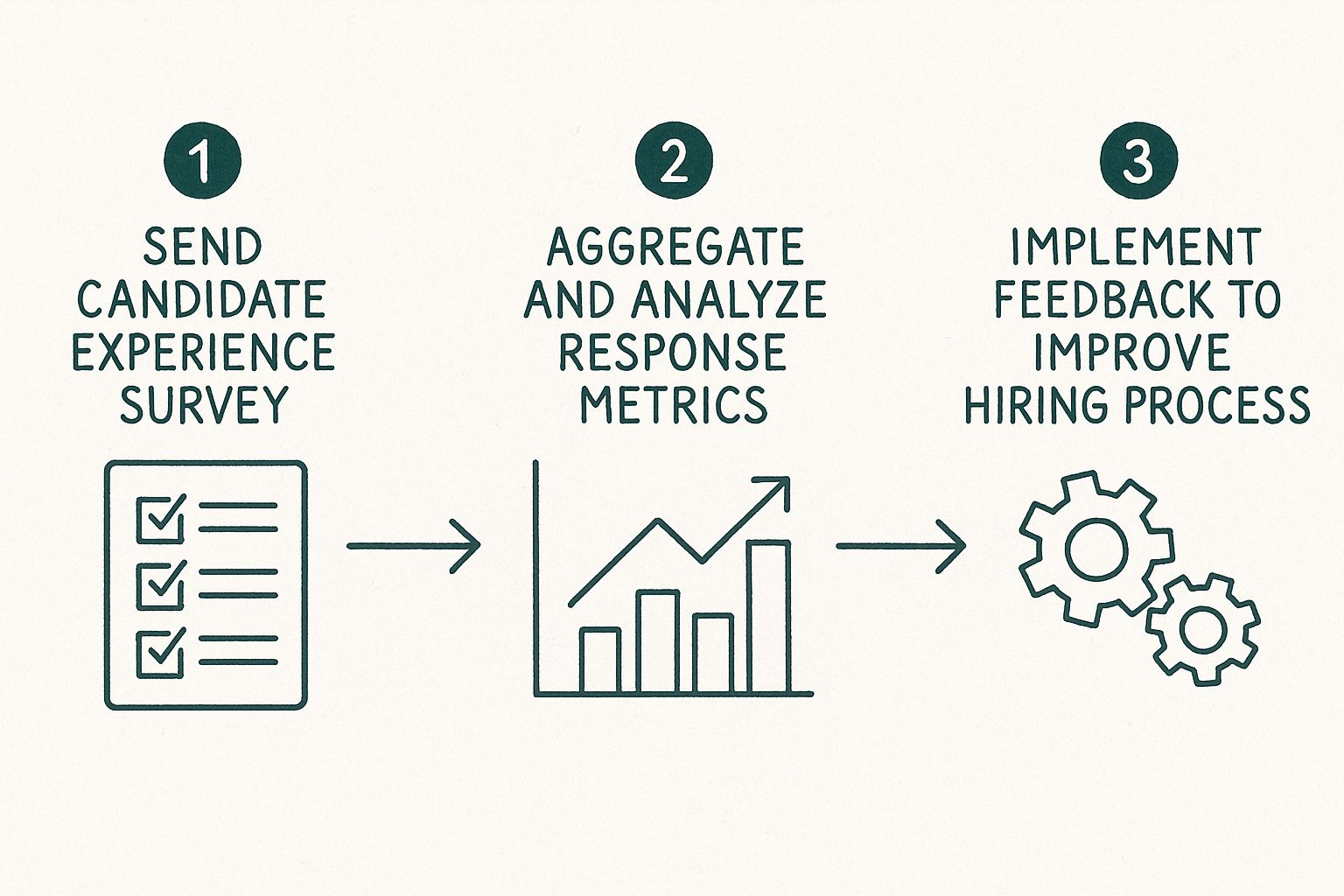

This entire feedback loop—from sending the survey to analyzing and implementing changes—is what refines your hiring engine over time. It’s a cycle.

The visual below breaks down this simple workflow for turning candidate feedback into tangible improvements.

This illustrates the core idea perfectly: collect, analyze, and implement. It’s a straightforward loop that turns raw opinions into a smarter, more efficient recruitment strategy.

Mix Up Your Questions to Avoid Fatigue

Relying on one question type is a recipe for boredom. A good candidate experience survey uses a strategic mix of formats to keep people engaged while gathering both quantitative and qualitative data.

It’s all about asking the right question at the right time. For instance, what you ask a candidate who just applied is very different from what you'd ask someone who went through three rounds of interviews.

This table provides a simple blueprint for structuring your questions based on where the candidate is in your pipeline.

Candidate Survey Question Blueprint

| Hiring Stage | Question Focus | Example Question |

|---|---|---|

| Application | Ease of Use & Clarity | On a scale of 1-5, how easy was it to complete our online application? |

| Initial Screening | Recruiter Professionalism | How would you rate the communication you received from our recruiting team? |

| Interview Rounds | Interviewer Preparedness | Did you feel your interviewer(s) were well-prepared for your conversation? (Yes/No) |

| Final Decision | Overall Perception & Fairness | What is one thing we could do to improve our interview process for future candidates? |

| Offer Stage | Offer Clarity & Competitiveness | Was the compensation and benefits package clearly explained to you? (Yes/No) |

By tailoring your questions, you get much more specific and useful feedback. It shows you're paying attention to the details of their journey.

The Best Question Formats to Use

Here’s a quick breakdown of what works and why:

- Likert Scales (1-5 ratings): These are fantastic for quick, quantifiable feedback. Ask them to rate things like, "How prepared was your interviewer?" or "How clear was the job description?" They're easy to answer and even easier for you to analyze for trends.

- Multiple-Choice: Use these for specific, factual questions where you need clean data. For instance, "How did you first hear about this role?" is perfect for tracking the ROI of your job boards or referral programs.

- Open-Ended Questions: This is where the real gold is. Use them sparingly but make them count. A single question like, "If you could change one thing about our interview process, what would it be?" will give you more brutal honesty than a dozen rating scales ever could.

By blending these types, you make the survey feel more dynamic. It prevents that robotic, repetitive feeling that causes people to abandon it halfway through. For more inspiration, check out these excellent candidate feedback examples to see how different question formats can uncover unique insights.

Remember, every question should earn its place on your survey. If you can't act on the answer, don't ask the question.

When and How to Ask for Feedback

Timing is everything. Asking for feedback at the wrong moment is like sending a review request before a product has even shipped—it's just annoying, and the data you get back is useless. Blasting a generic survey to every candidate and hoping for the best won't get you anywhere. You need a playbook.

The secret is to tie your survey triggers to the most critical moments in the candidate journey. Don't wait until the very end to ask about something that happened three weeks ago. By then, their memory is fuzzy, and the feedback will be watered down.

The Critical Touchpoints for Feedback

In my experience, there are three non-negotiable moments where you absolutely have to ask for feedback. Each one requires a slightly different approach because you're measuring a completely different part of the experience.

- Post-Application (Rejected Candidates): This is your first line of defense. A quick, two-question survey sent the day after a candidate is rejected can instantly tell you if your application process is a digital nightmare. Is your site crashing? Is uploading a resume impossible? This is where you find the technical glitches costing you great talent before you even get a chance to speak with them.

- Post-Interview (All Candidates): Whether they move on or not, every candidate should get a survey within 24 hours of their last interview. This is your best chance to get a read on your hiring managers and interviewers. Were they prepared? Did they represent the company well? This feedback is what you'll use to coach your team and ensure everyone provides a consistent, high-quality experience.

- Post-Decision (Offer vs. Rejection): This one is the big kahuna. For candidates who accept your offer, you want to know what sealed the deal. For those who declined, you need to understand why. And for the candidates you ultimately rejected, their feedback is pure gold because it’s completely unfiltered.

The most brutally honest—and therefore most valuable—feedback almost always comes from candidates you rejected. They have nothing to lose by telling you the truth about a confusing process or an unprepared interviewer.

Automate It So It Actually Happens

Look, don't leave this to chance. Manually sending surveys is a recipe for failure. Someone will get busy, forget, or send it two weeks too late. This is exactly where your Applicant Tracking System (ATS) becomes your best friend.

Go into your ATS and set up automated triggers that fire off the right survey when a candidate’s status changes. For instance, when a recruiter moves a candidate to a “Rejected Post-Interview” stage, the system should automatically send your post-interview survey.

This ensures every single candidate gets a chance to respond while the experience is still fresh. It’s consistent, it’s scalable, and it turns your feedback collection process from a manual chore into a data-generating machine that runs on autopilot.

Candidates are also playing the long game now. Research shows 42% of candidates plan to stay at their next job for 3-5 years, with another 28% aiming for over 10 years. They're looking for stability and a company that has its act together from day one. A timely, professional survey shows you’re a company that cares about improvement—a major green flag for top talent. You can dive into the complete report on candidate expectations to better understand this mindset.

Turning Raw Feedback Into Smarter Hiring

Alright, you’ve collected a mountain of responses from your candidate experience survey. Fantastic. Now what? A pile of raw data is about as useful as a screen door on a submarine unless you know how to turn it into action.

This is where most companies drop the ball. They get mesmerized by vanity metrics like the Candidate Net Promoter Score (cNPS), slap a pretty number on a presentation slide, and call it a day. But the real gold isn’t in the score; it’s buried in the open-ended comments—the brutally honest one-liners that tell you exactly where your process is broken.

Look for the Painful Patterns

Your real job here is to play detective. Don't just skim the comments; start tagging them. You don't need a complex data science project for this. Just create simple, intuitive categories for the feedback you’re seeing.

- Interviewer Issues: Tag any comment mentioning a specific interviewer by name or a general feeling of being disrespected, rushed, or interviewed by someone who clearly hadn't read their resume.

- Process Bottlenecks: Anything related to scheduling nightmares, ghosting between rounds, or a confusing number of interviews gets this tag.

- Tooling Troubles: Comments about a clunky application portal, a buggy video interview platform, or a broken assessment link get their own category.

- Job Description Mismatch: Flag responses where candidates felt the role they interviewed for was wildly different from what the job ad described.

After a few weeks of this, you won't just have random anecdotes. You’ll have a heat map showing you exactly where the fires are burning hottest. If 20% of your feedback mentions that your technical assessment is a soul-crushing, eight-hour ordeal, you don’t have a candidate problem—you have a process problem.

From Anecdotes to Action

Once you've identified a recurring theme, the next step is deceptively simple: fix it. Don't overthink it. Don’t form a committee to discuss the findings for six months. Just act.

Collecting feedback and doing nothing with it is worse than not collecting it at all. It signals to candidates that you don't actually care, and it tells your team that this whole survey thing is just corporate theater.

Here’s what this looks like in the real world:

- The Problem: You notice a pattern of candidates calling out one specific hiring manager for being chronically unprepared and dismissive.

- The Action: You pull that manager aside for a frank, data-backed conversation. You provide coaching, maybe shadow them in their next interview, and set crystal-clear expectations. It's not personal; it's about the candidate experience.

- The Result: Feedback scores for interviews involving that manager start trending up. Candidates feel respected, and, what do you know, the offer acceptance rate for their team improves.

This is how you turn a survey from a passive data collection tool into an active, strategic weapon. It’s all about making small, consistent tweaks based on what people are actually telling you. This iterative approach is the only way to genuinely improve the candidate experience for the long haul.

It isn't glamorous work, but it's what moves the needle. This is how you stop losing great people to tiny, totally fixable frustrations. Whether it’s rewriting a confusing job ad, retraining a manager, or finally ditching that soulless one-way video interview, the path forward is already written in the feedback you’ve collected. You just have to listen.

Choosing the Right Tech for Candidate Surveys

Alright, let's talk tech. You don't need to mortgage the office ping-pong table to afford a great survey tool, but I can tell you from experience that choosing the wrong one is just as costly. The goal here is to build a stack that actually works for you, not the other way around.

A clunky, disconnected tool just creates more manual work, pollutes your data, and completely defeats the purpose of running a candidate experience survey in the first place. This brings me to your number one priority: integration.

The Non-Negotiable ATS Connection

If a survey platform doesn't talk directly to your Applicant Tracking System (ATS), walk away. Seriously. A seamless connection isn't just a "nice-to-have"—it's the bedrock of automating survey delivery and keeping your data clean.

Think about it: when a candidate's status changes in your ATS (like moving from "interviewed" to "rejected"), the survey should fire off automatically. No spreadsheets, no manual triggers, no excuses. This is how you build a scalable feedback loop that ensures you get honest, in-the-moment feedback from candidates when it matters most.

Critiquing Your Tech Options

You've got a few paths you can take, and each one comes with its own baggage. I've been down all of them at some point, so here's my unfiltered take.

- Dedicated Survey Platforms: These are your best bet, hands down. Tools built specifically for employee or candidate feedback are designed for this exact purpose. They integrate smoothly with major ATS platforms and offer the kind of robust analytics you actually need.

- Built-in ATS Modules: Some ATSs have their own survey features baked in. They’re convenient for getting started, but they often lack the sophisticated analytics and customization of a dedicated tool. It’s a decent starting point, but you'll probably outgrow it fast.

- The Scrappy Route (aka Google Forms): When you're just starting and the budget is zero, Google Forms can work. It's free and technically gets the job done, but it's a manual nightmare. You'll spend far more time wrestling with data than actually analyzing it.

When you're weighing your options, it's worth exploring guides on the best market research tools, as many of their features are directly applicable to collecting high-quality feedback.

A Word of Caution on AI and Chatbots

Everyone wants to slap "AI" on their recruiting process. But where does it actually help with candidate surveys? Honestly, not as much as you'd think. While AI is fantastic for tagging and analyzing qualitative feedback, using chatbots to collect it can feel cold and impersonal.

Candidates are talking to a robot, and they know it. This can quickly create a frustrating, circular experience that damages the very thing you're trying to measure. This isn't just a hunch; the data backs it up.

An analysis of Fortune 500 companies revealed that 83% lacked chatbots to assist with candidate job recommendations and 87% performed poorly in deploying AI for personalization. This signals a massive gap between the tech available and its effective use.

There’s a clear disconnect between the promise of AI and the reality of its implementation. For a deeper dive, check out the findings in this State of Candidate Experience report.

The takeaway is simple: use tech to automate the tedious parts so you can be more human in the moments that matter. We have a whole guide on the right way to approach recruitment automation software that you might find helpful. Your tech stack should empower your team, not try to replace it.

Candidate Experience Survey FAQs

Alright, let's cut through the noise. You've got questions, and I've got direct answers based on years of getting this wrong before I finally got it right. No fluff, just the straight goods on running a candidate experience survey that actually works.

What Is a Good Survey Response Rate?

Honestly, if you're getting anything over 20%, you're not failing. But don't pop the champagne just yet. The real goal should be hitting the 40-50% range. A high response rate, especially from candidates you rejected, is where the gold is buried.

To get there, make your survey brutally short (under three minutes, max), ensure it works flawlessly on a phone, and send it within 24 hours of a decision. Most importantly, tell them why you're asking. People are surprisingly willing to help when they know their feedback will actually be used to fix a broken process.

Should We Offer Incentives for Surveys?

Hard pass. I'm generally against it. Tossing a $5 gift card at someone can seriously pollute your data. You'll attract people who just want a free coffee, not those who have genuine, unfiltered feedback to share. It feels transactional and cheapens the entire exchange.

Your "incentive" should be the implicit promise of a better, more respectful process for the next person. If your response rates are in the gutter, the problem isn't a lack of incentives—it's a bad survey or terrible timing. Fix that first.

How Often Should We Analyze the Results?

Don't let this data gather digital dust. You need to be looking at this stuff quarterly, at an absolute minimum. If you're hiring at a high volume, I'd argue for a monthly check-in. The whole point is to spot a problematic trend before it turns into a full-blown dumpster fire.

Set up a recurring, no-excuses meeting with your hiring managers and recruiting leads. Go over the findings and—this is the critical part—commit to fixing one or two concrete things before the next meeting. Small, consistent improvements will always beat a massive, chaotic overhaul once a year. It's about building momentum, not boiling the ocean.

Ready to stop guessing and start building a hiring process that top candidates love? Async Interview gives you the tools to gather feedback and streamline your screening process, helping you hire up to 10x faster. Start your free trial today and see how video interviews can transform your recruitment.