Let’s be honest. Hiring feels like a guessing game far too often. You post a job, cross your fingers, and hope the right person magically appears. But hope isn't a strategy, and "gut feelings" don't scale. If your recruiting process feels like you're just admiring the problem instead of solving it, you're likely tracking the wrong things—or nothing at all. This is where a sharp focus on Key Performance Indicators (KPIs) in recruiting separates the amateurs from the pros.

This isn't another theoretical guide filled with vague advice. We’re diving deep into the eight metrics that actually move the needle, transforming your talent acquisition from a cost center into a strategic weapon. And before we get into the weeds, it's worth knowing how these metrics fit into the bigger picture. For a solid primer, exploring the fundamentals by understanding the key differences between OKRs and KPIs is a great start.

In this article, you'll get the formulas, benchmarks, and no-fluff, actionable steps to improve each KPI. We'll cover everything from the classic Time to Fill and Cost Per Hire to the often-overlooked (but critical) Quality of Hire and Hiring Manager Satisfaction. Get ready to stop guessing and start building a predictable, data-driven hiring machine.

1. Time to Fill

If your hiring process feels like a slow-motion train wreck, Time to Fill is the metric that proves it. This foundational KPI in recruiting measures the number of calendar days from when a job requisition gets the green light to the moment a candidate signs on the dotted line. It’s the ultimate report card on your team's efficiency—or lack thereof.

Think of it as the clock ticking on your company's growth. Every extra day a key role sits empty is a day of lost productivity, missed opportunities, and mounting pressure on the rest of the team. A high Time to Fill isn't just an HR problem; it's a business bottleneck that screams "we're indecisive" or "our process is a nightmare."

Why It Matters

A low Time to Fill means you’re agile, competitive, and decisive. A high one? You’re losing top candidates to faster-moving competitors. It’s that simple. Tech giants learned this the hard way. Google famously slashed its Time to Fill from a painful 120+ days down to a lean 47 by streamlining its notoriously long interview loop. They realized that taking forever to decide wasn't a sign of diligence; it was a sign of indecision that cost them A-players.

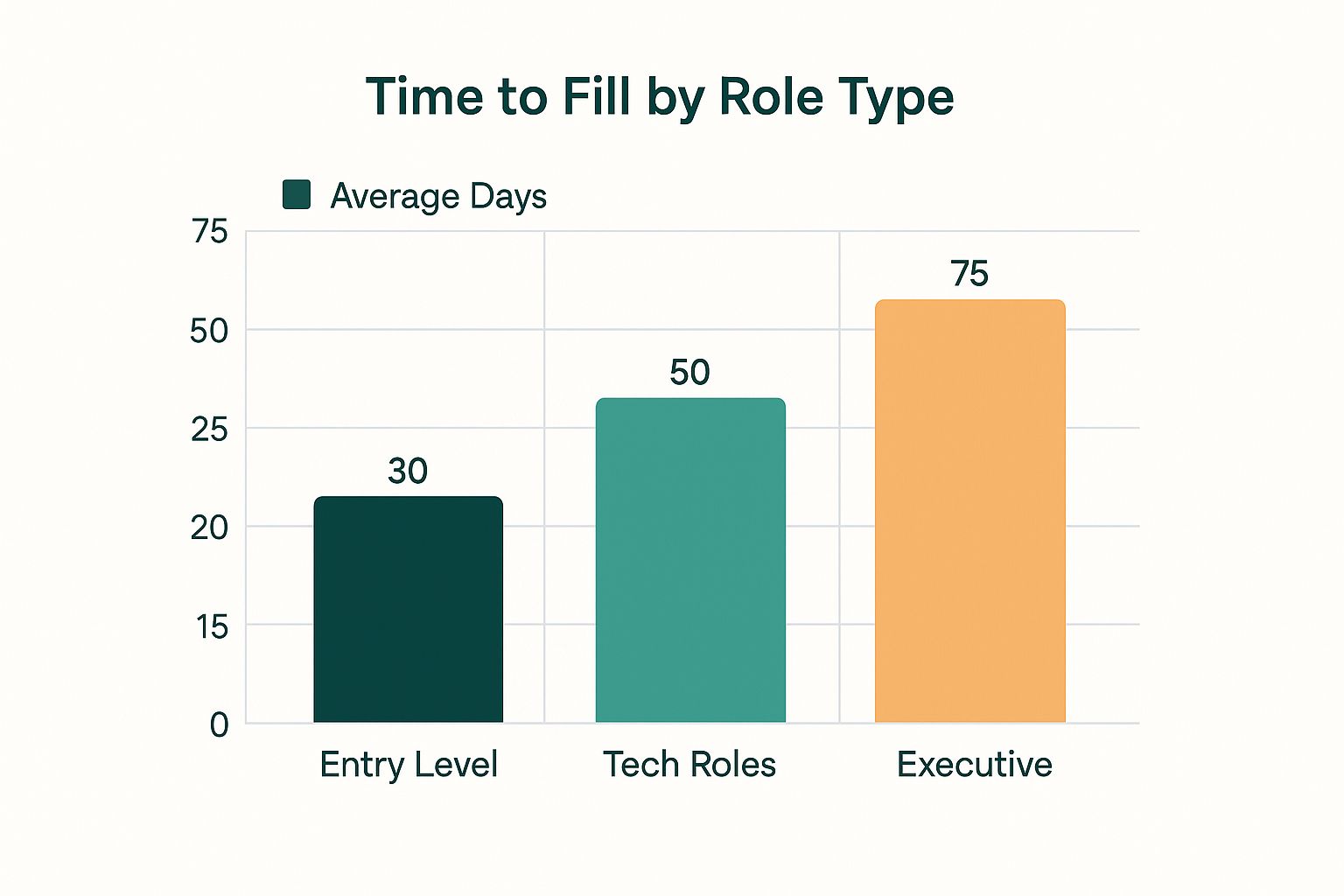

The following bar chart illustrates how this crucial KPI in recruiting varies significantly based on role complexity.

The data clearly shows that specialized and leadership roles require a much longer and more strategic recruitment cycle.

How to Improve It

Lowering this number requires more than just telling your recruiters to "hurry up." That's a fool's errand.

- Segment Your Metrics: Don't lump all roles together. Track Time to Fill separately for tech, sales, and executive positions. Your benchmark for a software engineer shouldn't be the same as for an entry-level sales rep. It's just common sense.

- Audit Your Stages: Pinpoint where the delays happen. Is it at the initial screening, the technical assessment, or the final offer stage? Fix the specific cog in the machine that's grinding things to a halt.

- Balance Speed and Quality: The goal isn't just to hire fast; it's to hire well, fast. Rushing leads to costly mis-hires. If you're struggling to find the right balance, there are resources that can help you reduce your Time to Fill without sacrificing candidate quality.

2. Cost Per Hire

If your recruiting budget feels more like a suggestion than a science, Cost Per Hire is the KPI that brings the cold, hard numbers into focus. This metric calculates the total investment required to fill a single position, bundling everything from recruiter salaries and tech subscriptions to agency fees and that "welcome lunch" for the new hire. It’s the ultimate financial accountability check for your talent acquisition function.

Think of it as the price tag on talent. A high Cost Per Hire isn't just a number on a spreadsheet; it’s a direct hit to your company's bottom line. It forces you to ask tough questions: Are we overpaying for job ads? Is our tech stack bloated? Are we relying too heavily on expensive agencies for roles we could fill ourselves?

This KPI in recruiting reveals the true cost of your growth engine and is fundamental for strategic budget planning.

Why It Matters

A low Cost Per Hire demonstrates operational efficiency and a strong return on investment. A high one signals that your acquisition channels are bleeding cash. For instance, Marriott slashed its hiring costs by a whopping 25% simply by optimizing its employee referral program, proving that sometimes the most valuable candidates are already in your network. Sometimes the best solutions are staring you right in the face.

On the other hand, a company like Zappos willingly accepts a higher Cost Per Hire because it invests heavily in cultural fit assessments upfront. Their logic is simple: paying more now prevents the catastrophic costs of a bad hire and poor retention later. It’s a strategic trade-off between cost and quality.

How to Improve It

Getting this number down isn't about cutting corners; it's about spending smarter.

- Track Everything: Don't just count the obvious stuff. Factor in "hidden" costs like the hours hiring managers spend in interviews, onboarding expenses, and technology subscription fees. Get granular to find the real cost drivers.

- Segment by Role: Your Cost Per Hire for a senior engineer will, and should, be different from that of a customer service representative. Segmenting by department, role type, and seniority level gives you a much clearer picture of where your money is actually going.

- Audit Your Channels: Regularly review which sources deliver the best candidates for the lowest cost. If you're spending thousands on a premium job board that yields only a handful of qualified applicants, it’s time to reallocate that budget to a more effective channel like referrals or targeted sourcing. For more ideas, you can explore proven strategies to reduce your recruitment costs while boosting efficiency.

3. Quality of Hire

If you're hiring fast but the new hires are fizzling out faster than a free office LaCroix, Quality of Hire is the KPI in recruiting that stops you from celebrating empty victories. This metric is the ultimate truth serum for your hiring process, measuring how well new employees actually perform once they’re on the job. It's the difference between filling a seat and adding a genuine A-player to the roster.

Think of it as the long-term ROI on your recruitment efforts. A low-quality hire isn't just a recruiting fumble; it's a productivity drain, a culture-killer, and a massive time-suck for managers. Focusing only on speed or cost is like buying the cheapest car you can find without checking if it has an engine. Quality of Hire forces you to look under the hood.

This KPI combines multiple data points to create a holistic picture of hiring success.

Why It Matters

A high Quality of Hire is the clearest sign that your recruitment engine is firing on all cylinders. It means your sourcing, interviewing, and selection processes are aligned to find people who not only have the skills but who also thrive in your environment. Salesforce, for example, measures time-to-quota for its sales hires, directly linking recruitment success to revenue generation. That's how a pro thinks.

This isn't just about feeling good; it's about building a resilient, high-performing organization. Getting this metric right is a powerful lever for long-term business growth. It's the one KPI that truly justifies your entire existence.

How to Improve It

Boosting your Quality of Hire requires moving beyond gut feelings and into data-driven decisions.

- Define "Quality" Before You Hire: Don't make it up as you go. Before the role is even posted, decide what success looks like. Is it performance review scores at six months? Hitting sales quotas? Positive 360-degree feedback? Define the metrics upfront.

- Combine Hard and Soft Data: Quality isn't just about performance ratings. Blend quantitative measures (like retention rates, time to productivity) with qualitative insights (like cultural fit assessments from managers and peers). One without the other tells an incomplete story.

- Track Quality by Source: Where are your best hires coming from? Are employee referrals consistently outperforming candidates from a specific job board? Use this data to double down on the channels that deliver real talent, not just a high volume of resumes.

4. Source of Hire Effectiveness

If you’re still throwing money at every job board and hoping for the best, Source of Hire Effectiveness is the KPI in recruiting that will save your budget. This metric goes beyond just counting applicants from different channels; it reveals which sources actually deliver high-quality employees who stick around. It’s the difference between buying a lottery ticket and building a diversified investment portfolio.

Think of it as your recruiting GPS. Without it, you're driving blind, spending cash on platforms that bring in a high volume of candidates who never make it past the first interview. A finely tuned Source of Hire strategy means you know exactly where to find your next great engineer or sales leader, allowing you to double down on what works and cut the dead weight.

Why It Matters

Knowing where your best hires come from is a strategic superpower. It allows you to allocate resources with precision instead of guesswork. For example, Ernst & Young discovered that employee referrals led to 50% higher retention rates, prompting them to invest more heavily in their referral program. HubSpot found that sourcing from GitHub produced their highest-quality engineering hires, shifting their focus away from generic tech job boards. This isn't rocket science, it's just paying attention.

This isn't just about saving money on job ads; it's about building a predictable, high-performance talent pipeline. It tells you which channels produce employees who not only get hired but also thrive and contribute to your company's long-term success.

How to Improve It

Optimizing your sources requires a data-driven mindset, not a "spray and pray" approach.

- Track the Full Journey: Don't just credit the last click. Use your Applicant Tracking System (ATS) to track both the initial source and every touchpoint a candidate has. Was the initial contact through a referral, but they applied via LinkedIn? That’s crucial data.

- Measure Quality, Not Just Quantity: Go beyond just counting hires per source. Connect sourcing data to performance reviews, retention rates, and promotion velocity. A source that delivers fewer hires who become top performers is far more valuable than one that delivers high volume but low quality.

- Review and Adjust Relentlessly: Your best sources today might not be your best sources next quarter. The market moves fast. Set a recurring calendar reminder to analyze your source effectiveness data. Be ready to pivot your strategy and reallocate your budget based on what the numbers tell you.

5. Candidate Experience Score

If your Glassdoor reviews read like a horror story, your Candidate Experience Score is the KPI that’s screaming for help. This metric moves beyond internal efficiency and asks a brutally honest question: what was it actually like for the human on the other side of the process? It measures how candidates perceive your company from their first click to their final email, whether they got an offer or a rejection.

Think of it as your recruiting team’s Net Promoter Score. A terrible experience doesn't just lose you one candidate; it creates a brand detractor who tells their network, leaves scathing reviews, and poisons your talent pool. In today's transparent world, a clunky, disrespectful, or ghost-filled process is a direct hit to your employer brand and your bottom line. This isn't a fluffy, feel-good metric; it’s a core business KPI in recruiting with real financial consequences.

Why It Matters

A great candidate experience turns every applicant, hired or not, into a potential brand ambassador or even a future customer. Virgin Media calculated that their poor candidate experience was costing them an estimated £4.4 million annually in lost revenue from spurned applicants who were also customers. They fixed it and turned that loss into a gain. That’s not a rounding error, folks.

This shows that treating candidates with respect isn't just nice; it's a strategic move that protects your brand and revenue. A high score means you’re creating fans, even among those you don’t hire, which is one of the most powerful competitive advantages in a tight talent market.

How to Improve It

Boosting this score requires you to stop thinking like a recruiter and start thinking like a candidate.

- Survey at Key Touchpoints: Don't wait until the end to ask for feedback. Send short pulse surveys after the initial application, after the first interview, and after the final decision. This gives you stage-specific data to pinpoint exactly where the experience breaks down.

- Keep It Short and Sweet: No one wants to fill out a 50-question survey after being rejected. Ask 3-5 pointed questions focused on communication, respect, and process clarity. Was the interviewer prepared? Did you receive timely updates? Simple stuff.

- Close the Loop: The single biggest driver of a negative experience is getting ghosted. It's also the easiest to fix. Acknowledge feedback publicly or in follow-up communications. When you make a process change based on suggestions, announce it. This proves you’re actually listening, which is critical if you want to improve the candidate experience for real.

6. Offer Acceptance Rate

If getting a "yes" feels harder than getting a venture capital check, your Offer Acceptance Rate is the KPI that’s telling you why. This metric calculates the percentage of formal job offers that candidates accept. It’s the final exam of your entire recruitment process, revealing just how compelling your company, role, and compensation package truly are.

Think of it as the ultimate market feedback. A low acceptance rate isn't just a string of bad luck; it’s a glaring sign that your pitch is falling flat. Either your compensation is out of touch, your culture seems toxic, or your hiring process left candidates feeling more interrogated than inspired. Every rejected offer means you’re back to square one, burning time and money while your top choice starts their new job at your competitor.

Why It Matters

A high Offer Acceptance Rate is a powerful indicator that you’ve aligned what you offer with what top talent actually wants. It’s a crucial kpi in recruiting that signals a strong employer brand and an effective closing strategy. Netflix famously maintains a 95%+ acceptance rate, not by throwing money blindly, but through obsessive compensation research to ensure its offers are practically irresistible.

When candidates decline, they aren't just rejecting a salary; they are rejecting the entire experience and the future they envision at your company. That should sting. And it should make you want to fix it.

How to Improve It

Boosting this number requires more than just adding another zero to the salary.

- Systematically Track Rejection Reasons: Don't just shrug when a candidate says no. Create a simple dropdown in your ATS for recruiters to log the reason: compensation, culture, better offer, role scope, etc. This data is gold for pinpointing your weak spots.

- Benchmark Compensation Relentlessly: You can't make a competitive offer if you don't know what "competitive" means this quarter. Use real-time market data to benchmark salaries, bonuses, and equity, and be prepared to justify every number to a savvy candidate.

- Arm Your Team with a Compelling Value Proposition: Ensure everyone, from the recruiter to the CEO, can articulate why someone should work for you beyond the paycheck. Sell the career, not just the job.

- Build Relationships, Don't Just Conduct Interviews: The offer stage shouldn't be the first time a candidate feels truly wanted. Maintain warm, transparent communication throughout the process. A strong relationship can often be the tie-breaker when a candidate is weighing multiple offers.

7. Time to Productivity

Hiring someone is just the start of the race; Time to Productivity tells you when they actually cross the finish line. This crucial KPI in recruiting measures the time it takes for a new hire to get fully up to speed and contribute value at the level you expect. It’s the ultimate reality check on your hiring decisions and the effectiveness of your onboarding.

If your Quality of Hire metric is your prediction, Time to Productivity is the result. A long ramp-up period means your "great hire" is just an expensive trainee for months on end, draining resources and delaying ROI. It’s a direct hit to the bottom line and a signal that something is broken in either who you hire or how you integrate them.

Why It Matters

A short Time to Productivity is proof that your recruiting engine is delivering not just bodies, but plug-and-play contributors. It shows you’re accurately assessing skills and your onboarding process is a well-oiled machine. A long ramp-up time suggests a disconnect between the job description and the reality of the role, or an onboarding program that’s more of a "here's your laptop, good luck" affair.

Industry leaders obsess over this. Accenture slashed its Time to Productivity by a staggering 35% by shifting to skills-based hiring, proving that focusing on demonstrable capabilities pays off faster than relying on credentials alone. This is a KPI in recruiting that directly ties hiring efforts to business output. No excuses.

How to Improve It

Shortening the runway from new hire to star performer requires a two-pronged attack on your hiring and onboarding.

- Define and Benchmark: You can't improve what you don't measure. Establish clear, role-specific productivity milestones. For a salesperson, it might be their first sale; for an engineer, their first solo code deployment. Track these benchmarks to create a baseline.

- Bridge the Hiring-Onboarding Gap: Ensure the skills you screen for are the ones needed on day one. Your onboarding should be a direct extension of the recruitment process, designed to activate the talent you just hired, not re-teach them the basics.

- Separate the Variables: Is the lag due to a poor hiring choice, or a weak training program? Analyze where new hires struggle. If they lack foundational skills, your screening is the problem. If they have the skills but don’t know your systems, your onboarding needs a tune-up.

8. Hiring Manager Satisfaction

If your recruiters are high-fiving over a new hire but the hiring manager looks like they’ve just been handed a participation trophy, you’ve got a problem. Hiring Manager Satisfaction is the KPI in recruiting that measures how happy your internal customers are with both the process and the person they just hired. It’s the ultimate check on whether your talent acquisition team is a strategic partner or just a resume-forwarding service.

Think of it as your internal Net Promoter Score. A thrilled hiring manager becomes an advocate for your process, trusting your judgment and moving quickly on your candidates. An unhappy one becomes a bottleneck, second-guessing every submission and complaining that "no one understands what I need." This isn't about feelings; it's about the friction that kills hiring velocity and damages internal relationships.

Why It Matters

High satisfaction means your recruiting team is aligned with business needs, not just hitting activity metrics. It proves you understand the subtle, unwritten requirements of a role. Adobe, for example, saw a 40% jump in hiring manager satisfaction after rolling out scorecards to systematically capture feedback. They didn't just ask "are you happy?"; they dug into the quality of candidate sourcing, communication, and process efficiency.

This KPI in recruiting forces a partnership. It stops the blame game and encourages collaborative problem-solving. When satisfaction dips, it’s a clear signal to investigate whether there's a mismatch in expectations, a flaw in the screening process, or a need for better communication between the recruiter and the department head.

How to Improve It

Boosting this metric requires turning your hiring managers into partners, not just clients.

- Systemize Your Feedback Loop: Don't wait for the post-hire survey. Collect feedback at key stages: after the intake meeting, after the first round of candidates, and after the final interview. Use simple surveys or brief check-in calls.

- Focus on Actionable Insights: Instead of asking "How satisfied are you?", ask "What is one thing we could do to make the next candidate slate even better?". This shifts the focus from a complaint to a solution.

- Balance Demands with Reality: Sometimes a manager's "perfect candidate" is a unicorn. Use satisfaction data to have candid, data-backed conversations about market realities, compensation benchmarks, and realistic expectations.

- Share Best Practices: When you find a recruiter-manager partnership that consistently scores high, dissect it. What are they doing right? Document their communication cadence or intake process and scale it across the team.

Key KPI Metrics Comparison for Recruiting

| Metric | Implementation Complexity (🔄) | Resource Requirements (⚡) | Expected Outcomes (⭐📊) | Ideal Use Cases (💡) | Key Advantages (⭐) |

|---|---|---|---|---|---|

| Time to Fill | Low – straightforward calculation and tracking | Moderate – requires process data | Measures hiring efficiency and bottlenecks | Workforce planning, hiring speed optimization | Easy to understand, identifies delays, supports budgeting |

| Cost Per Hire | Medium – tracking various cost components | High – requires detailed cost accounting | Provides ROI on recruiting spend | Budgeting, cost optimization of recruiting channels | Enables budget allocation, compares sourcing costs |

| Quality of Hire | High – multi-dimensional and long-term measurement | High – needs performance, retention, and survey data | Holistic view of hiring success beyond speed or cost | Improving selection process, talent quality assurance | Correlates with business outcomes, validates hiring criteria |

| Source of Hire Effectiveness | Medium to High – tracking candidates from source to hire | Moderate – requires integrated sourcing data | Identifies most productive and high-quality sourcing channels | Recruiting channel optimization, resource allocation | Data-driven channel strategy, improves sourcing ROI |

| Candidate Experience Score | Medium – survey-based with subjective feedback | Moderate – surveys and analysis resources | Enhances employer brand and candidate retention | Employer branding, process improvement | Improves offer acceptance, increases referrals |

| Offer Acceptance Rate | Low – simple ratio calculation | Low to Moderate – needs offer and acceptance data | Reflects competitiveness of offers and sales effectiveness | Compensation strategy, candidate relationship management | Predicts hiring success, evaluates offer competitiveness |

| Time to Productivity | High – requires performance benchmarks and tracking | High – needs onboarding and performance data | Measures speed of new hire impact | Onboarding effectiveness, ROI on hire | Connects recruiting & onboarding, supports resource planning |

| Hiring Manager Satisfaction | Medium – feedback collection and survey analysis | Moderate – requires regular surveys and follow-up | Measures recruiting alignment with business needs | Internal stakeholder management, recruiting process improvement | Enhances recruiter-manager partnership, improves process alignment |

From Numbers to Narrative: Making Your KPIs Work for You

So, we’ve dissected the heavy hitters: Time to Fill, Cost per Hire, Quality of Hire, and all their cousins. You're now armed with the formulas, benchmarks, and tactical plays to stop guessing and start measuring what truly matters in your recruitment process. But let's be honest, collecting data is the easy part. The real magic, the part that separates the recruiting legends from the list-tickers, is turning those numbers into a compelling story.

A dashboard full of red and green charts is just noise until you give it a voice. Your recruiting KPIs shouldn't be a report card you nervously hand to the C-suite once a quarter. They should be the protagonist of your team's story—a living narrative that reveals your triumphs, uncovers your villains (hello, bottleneck in stage three), and points toward the treasure: exceptional talent.

The Shift from Scorekeeper to Strategist

The ultimate goal here isn't just to hit your targets; it's to understand the why behind them.

- Is your Offer Acceptance Rate low? Don't just shrug and bump up salaries. Your Candidate Experience Score might be screaming that your interview process feels like a DMV line.

- Is Cost per Hire skyrocketing? Before you slash your sourcing budget, look at Source of Hire Effectiveness. You might be pouring money into a channel that delivers quantity over quality, leading to longer fill times and wasted effort.

- Are you celebrating a fast Time to Fill? High-five, but then immediately check your Quality of Hire and Time to Productivity. Filling seats with the wrong people just to beat the clock is a classic rookie mistake, and it’s a costly one.

Each KPI in recruiting is a thread connected to another. Pull one, and the others move. The true art is seeing the whole tapestry, not just a single, isolated thread. This is how you move from being a reactive scorekeeper to a proactive talent strategist.

Making Your Data Do the Talking

To get there, you need to present your findings in a way that people actually understand and care about. A spreadsheet of raw numbers will get you ignored. A clear, visual story will get you budget and buy-in. To truly transform your recruiting KPIs into actionable insights, mastering effective data visualization best practices is crucial. It’s the difference between showing a map and just listing out coordinates. One guides action; the other causes headaches.

Ultimately, mastering your KPIs isn't about becoming a data scientist. It’s about becoming a better storyteller who uses data as their proof. It’s about confidently walking into any meeting and saying, "Here’s not just what happened, but why it happened, and here’s exactly what we’re going to do about it." That’s when the numbers stop being your judge and start being your most powerful ally.

Tired of juggling schedules and chasing candidates for initial screens? Async Interview helps you slash your Time to Fill by automating first-round interviews. Let candidates record their answers on their own time, so your team can focus on what matters: evaluating top talent, not managing calendars. Check out Async Interview and see how you can improve your most critical recruiting KPIs.